VOV.VN - While the tide of global trade has yet to stage a meaningful rebound, Vietnam has started the second half of the year with some stabilisation in its external sector, according to July’s data on the Vietnamese economy released by HSBC.

Domestic services continue to provide support in terms of offsetting trade weaknesses thanks to an ongoing recovery in terms of international tourism

Experts point out that inflation continues to cool, warranting another 50 basic point (bp) rate cut by the State Bank of Vietnam (SBV) ahead in the third quarter of the year, while also underlining the need to be mindful of upside risks to inflation from El Niño.

With regard to the external front, exports fell 3.5% on-year in July, partly due to base effects. Similarly, imports also fell by a smaller magnitude than previously, declining by 9.9% on-year. This has led to a sizeable trade surplus of US$2.2billion.

Meanwhile, subdued sentiment for the trade outlook continues in July, with manufacturing Purchasing Managers' Index (PMI) remaining in the contraction territory at 48.7. This marks the fifth consecutive month that the country’s PMI fell below the 50 threshold. That said, high frequency indicators are starting to show signs of stabilisation.

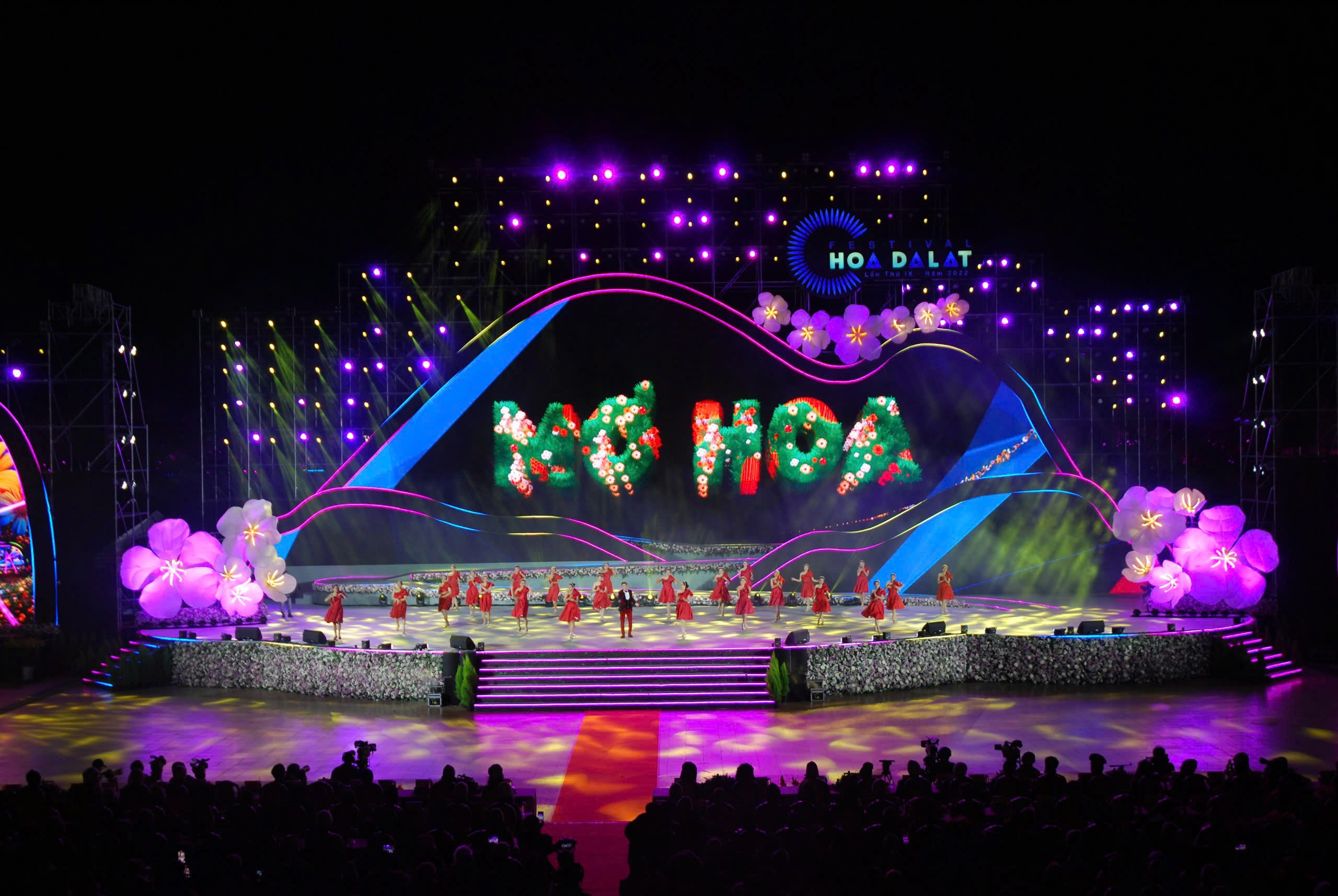

Retail sales rose by 7.1% year-on-year in July, with consumption on services an ongoing driver, rising by 7.5% on-year. Also, international tourists continue to flow, with July recording more than a million tourist arrivals. In particular, arrivals from mainland China and Taiwan (China) continued their momentum, largely thanks to the ongoing recovery in flight frequency.

Headline inflation rose by 2.1% on-year in July, remaining well below the State Bank of Vietnam’s (SBV) target of 4.5% for the year. More encouragingly, core inflation trended lower to 4.1% on-year, further away from the ceiling.

According to HSBC’s economists, following a lackluster GDP print of 3.7% in 1H23, green shoots have quietly emerged. Alas, challenges are not fading, although high frequency indicators point to some positive stabilisation.

However, the biggest surprise lies on the external front. While exports did not cease to fall on an annual basis, the magnitude was much smaller at 3.5%. Although this was in part due to favourable base effects, the level of exports in July rose to the highest level recorded in nine months. While major exports, including textiles/footwear and phones, continued to suffer from double-digit declines, computer and electronic components shipments surprisingly offset some weakness, seeing an annual jump of 32%. Granted, base effects came to the partial rescue, but signs are pointing to some valuable stabilization, especially from computer-related imports.

Despite these positives, the smartphone cycle continues to face intensifying headwinds. Whilst still being at an early stage, forward-looking PMI indicators point to some stabilisation in the nation’s near-term trade prospects and no further deterioration is the first step before a meaningful trade rebound.

Despite the ongoing external drag, Vietnamese FDI prospects remain intact. New FDI stood at 3% of GDP in the second quarter of the year, on par with that recorded back in 2022. While it slowed from the country’s peak of over 7% in 2017, tighter global monetary conditions in recent years partly explain the slowdown.

Compared to its peers, the nation still remains the second largest FDI recipient in ASEAN, measured as a percentage of GDP, behind only Malaysia. Tech giants across the world, including Infineon, LG, and Foxconn, continue to announce their expansion plans in the Vietnamese market. All of this provides hope for the country’s external sector to rebound strongly once the trade cycle turns.

Think tanks have outlined that outside of trade, Vietnamese domestic services continue to act as a pillar of support. A large part of the support being thanks to the uplift from international tourists, with mainland Chinese visitors continuing to steadily flock to the country, reaching around 45% of 2019’s level. For the first time in more than three years, the country has, once again welcomed more than one million visitors in a month.

Fortunately, the pace of Chinese visitors’ recovery is the highest in Vietnam, exceeding that in Thailand which is traditionally viewed as a market for outbound Chinese tourism in ASEAN. This is perhaps largely down to the country’s steady flight recovery with China, now standing at 53% of 2019’s level, just after Singapore at 75% and Malaysia at 57%. In addition, with the recent policy change in visa relaxation, which is expected to be implemented from mid-August, Vietnamese tourism outlook continues to be favourable.

Elsewhere, inflation continues to deliver some positive news. Headline inflation only rose by 2.1% on-year in July, well below the SBV’s 4.5% inflation ceiling, thanks to continuing energy disinflation.

While robust services mean that inflation will likely decelerate at a slower pace than headline inflation, inflation dynamics have become less of a concern for the SBV, warranting further monetary support.

Economists therefore expect the SBV to deliver another 50bp rate cut, the last one in the current easing cycle. Recently, the SBV has also signaled its openness to do more if “market conditions allow”.

That said, they must remain cautious of potential upside risks to inflation, not least due to the evolving El Niño phenomenon. Indeed, food inflation momentum has been strong for the past two months. Another factor stems from any subsequent energy price hikes, with the Vietnam Electricity Group (EVN) recently seeking the Government’s permission to hike electricity prices once again due to financial difficulties.

All in all, despite the tide having not yet fully turned, it is positive to see the nation start the second half of the year with some improvements in its economic activity.