VOV.VN - Vietnam will enjoy favourable conditions to fuel its economic recovery this year despite the global moderate growth forecast, said Paulo Medas, head of the International Monetary Fund (IMF) team to Vietnam.

Vietnam is able to maintain high economic growth in the medium term and become a greener economy. (Illustrative image)

Medas, speaking in an interview recently granted to Dau Tu (Investment) newspaper, noted that the national socio-economic recovery and development programme has proved to be effective in boosting consumption and production, while progress has also been made in public investment disbursement.

The State bank has competently controlled inflation and limited exchange rate disruptions without losing foreign exchange reserves. It has duly managed to ensure financial stability amid tightening financial conditions by major economies, although it now has not much room to lower policy interest rates.

As the fiscal policy plays a key role as part of supporting growth, the IMF Vietnam team leader suggested that the State bank should eliminate tools such as credit growth and deposit interest rate ceilings, and should instead apply market-based mechanisms along with appropriate macroprudential measures and flexible exchange rates.

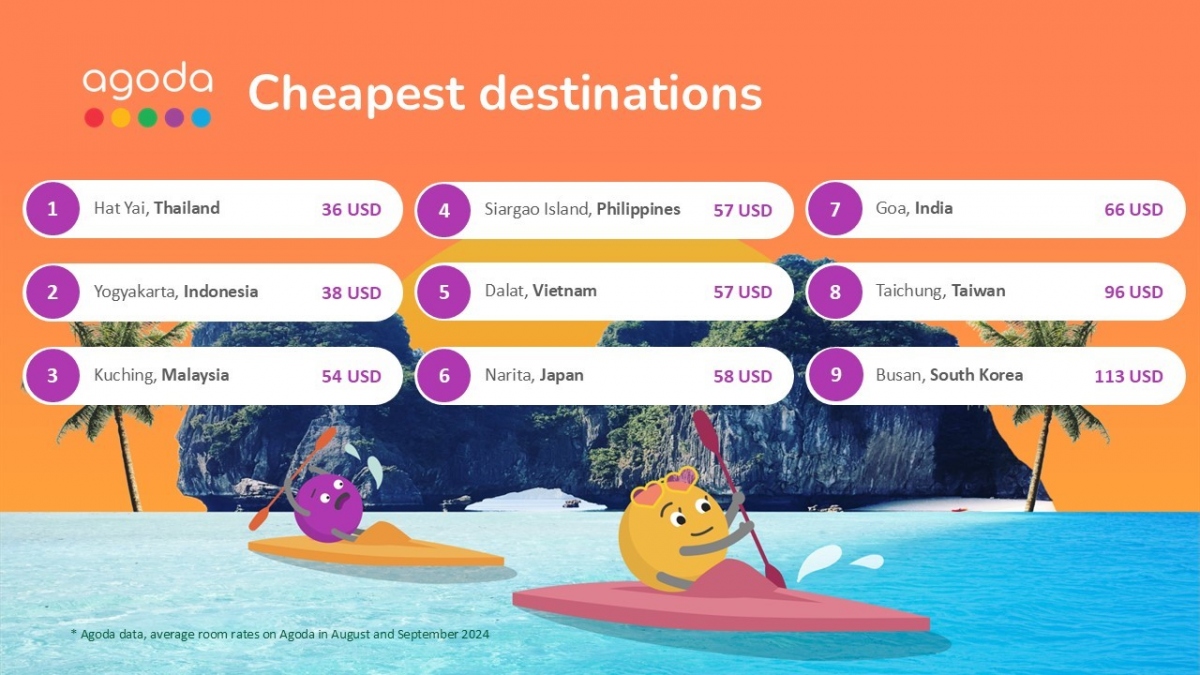

Medas cited the IMF’s latest projection, saying the Vietnamese economy could expand by 5.8% in 2024. Burgeoning exports would therefore motivate manufacturing and other export sectors to accelerate after the 2023 slowdown, whilst this would contribute to improving investment and consumption efficiency.

According to the expert, Vietnam is able to maintain high economic growth in the medium term and become a greener economy if it keeps pressing ahead with necessary economic and investment climate-related reforms.

It is important to quickly address weaknesses that could hinder growth, including issues in the real estate sector and underperformance in some businesses which could all harm the corporate bond market and impact the lending ability of banks, he said.