Foreign direct investments (FDI) has been one of the key catalysts spurring and transforming the nation into one of the most open economies in the region, said Joonsuk Park, head of International Subsidiary Banking and Wholesale Banking at HSBC Vietnam.

Joonsuk Park, Head of International Subsidiary Banking and Wholesale Banking at HSBC Vietnam.

Vietnam emerges as leading frontier market in Asia

The HSBC expert emphasised that the country has successfully emerged as a leading frontier market in Asia and is an export led economy. Multinational companies, as well as local exporters, therefore have the privilege of securing a highway pass enabling access to 15 of the G20 markets.

The Vietnamese Government has actively sought to embed free trade agreement (FTA) execution as a key instrument in which to lay the foundations to promote the country’s export growth. Indeed, the nation currently has 15 FTAs and multiple regional pacts, including the Regional Comprehensive Economic Partnership (RCEP) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

The Vietnamese domestic consumption market is in parallel another important arena for the incoming multinational companies, with an HSBC study showing that by 2030, the nation’s domestic consumption market will outsize the markets of Thailand, the UK, as well as Germany.

The FDI investors or those regional and global multinational companies operating in the Vietnamese market effectively contributes to over 80% of the total exports out of the country and more than 25% of local investments.

Of those multinational companies, the intra-Asian multinational companies compose the bulk of it, with Asian multinationals across the Republic of Korea, China, Hong Kong (China), Taiwan (China), Japan, Thailand, and Singapore playing an integral part.

Intra-Asian investors continue to maintain their focus on Vietnam

These top intra-Asian financiers continue to maintain their focus on the Vietnamese market. Following and supporting the flow of intra-Asian capital flow as part of the company’s pivot to Asia strategy, HSBC has been providing relevant advisory and treasury support to many multinational companies entering and operating in the nation and are duly pleased to see the annual investment inflows remain steady.

This year has already seen HSBC witness interest from a number of global intra-Asian multinationals engaging across a wide array of sectors, including retail, semiconductors, electronics, mobile parts, plastics, renewables, and logistics who are looking to either expand or invest into the country.

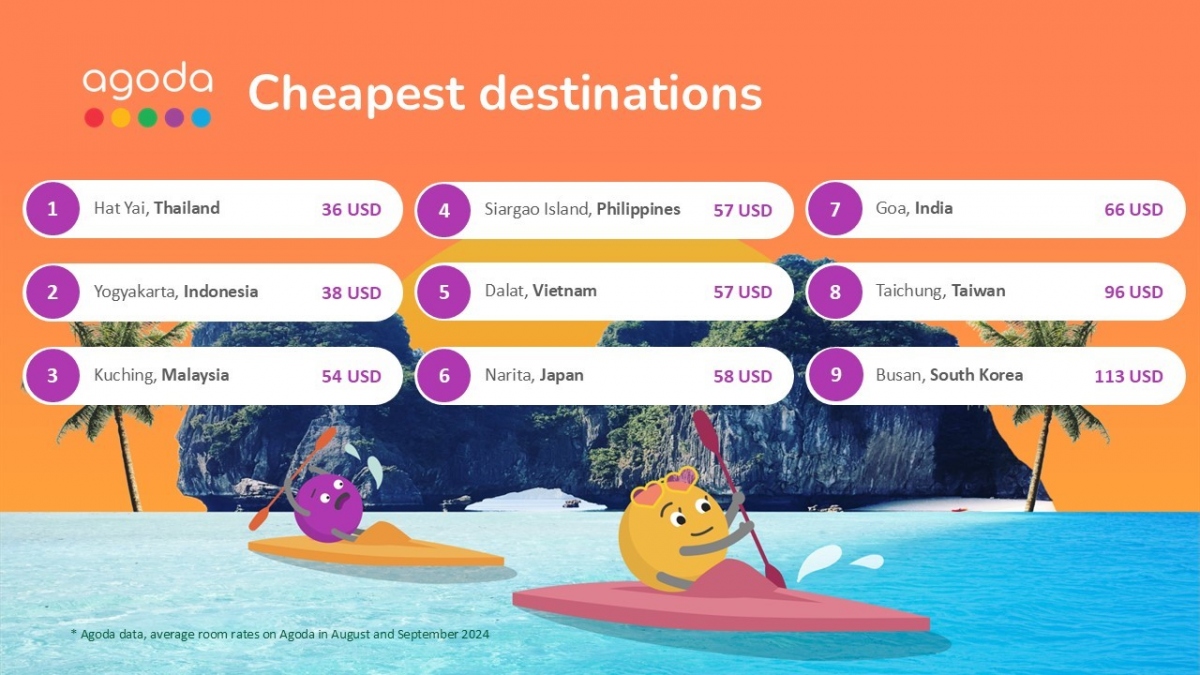

The HSBC economist pointed out that during recent meetings held with Thai investors, there is vigor, excitement, and confidence in how they are looking to further expand and invest across the feed mill, packaging, retail, manufacturing, and chemicals sectors on the back of mid- to long-term growth prospects in a market fraught with the right elements for growth.

Many prospect and existing FDI investors therefore harbor the view that the country will continue to benefit owing to an established manufacturing eco system put in place, cost competitiveness, a rising number of skilled workers, progressive regulatory support, as well as a growing middle income story.

HSBC therefore forecasts that Vietnamese GDP will grow by 5.8% in the year ahead, despite challenges remaining. The global trade recession has impacted the nation’s exports, with elevating inflation deterring domestic consumption. Elsewhere, whilst the re-opening of China is expected to positively impact Vietnam across FDI inflows, exports, and tourism.

The HSBC think tank underscored the importance of the intra-Asian flow as intra-Asian investors have a keen understanding of the Vietnamese market from both a cultural and business perspective.

Whilst Western multinationals battle with macro-economic challenges and geopolitical tensions, it may represent an opportune timing for Vietnam to focus its efforts on attracting more of the intra-Asian FDI flows into the country, he noted.

https://english.vov.vn/