VOV.VN - Many businesses from the United States and Europe are looking to pour investments into the mergers and acquisitions (M&A) market in Vietnam next year, a conference of the Global M&A Partners (GMAP) in Ho Chi Minh City heard on November 13.

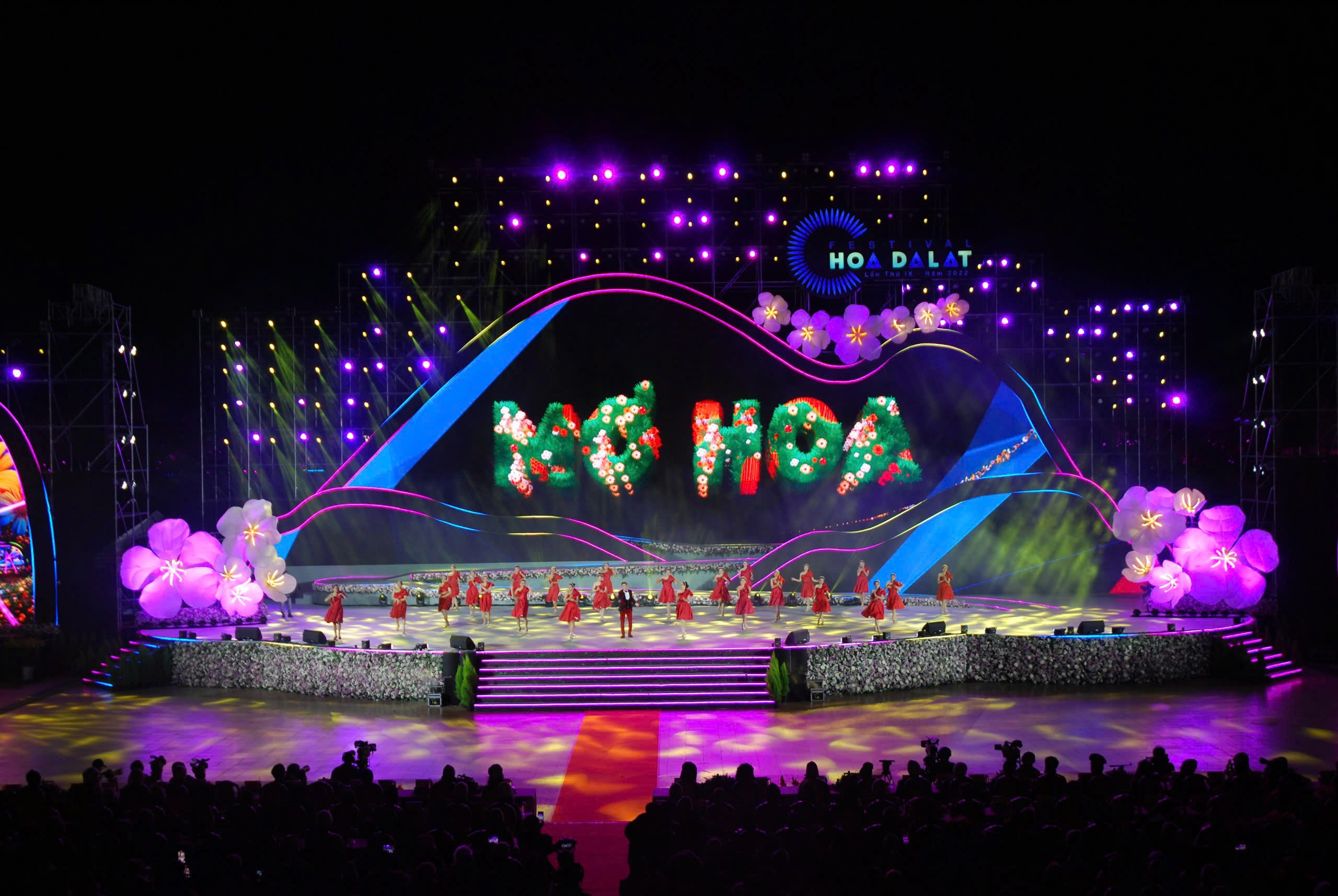

Executives of mergers and acquisitions firms share information at the GMAP conference in Ho Chi Minh City on November 13. (Photo: Kinh te Saigon online)

Vietnam is one of the most attractive destinations for foreign direct investment (FDI) in the world thanks to boasting a young population, impressive economic growth, and a rapidly growing number of middle-income consumers, said Ivan Alver, co-founder of GMAP.

In his view, the Southeast Asian country has succeeded over the years in attracting FDI to M&A deals from different Asian markets, including Japan, the Republic of Korea, Singapore, Thailand, Taiwan (China), and China. However, investments from Europe and both North America and South America remain limited.

There is currently a wave of fresh investment from the UK, the US, and Europe looking for opportunities in the Vietnamese market that possesses abundant human resources, helping businesses to build a large production capacity, said Alver.

He added that economic difficulties coupled with rising inflation in Europe have forced investors to urgently seek fresh markets in order to preserve their assets, with impressive Vietnamese economic growth receiving great attention.

The executive outlined the situation in several Asian countries, noting that Myanmar also has low labour costs, although this competitive advantage is decreasing. Meanwhile, China, which is the largest manufacturing market, has high labour costs which has prompted investors to shift their investments to other regional markets, including Vietnam.

The GMAP co-founder revealed that two Swiss investors have planned to move their manufacturing bases from China to Vietnam following recent field trips to explore the country’s infrastructure and labour force quality.

Sam Yoshida, managing director of RECOF Vietnam, an advisory firm for M&A deals between Japanese and Vietnamese businesses, said that his firm is looking for potential sellers for international investors, many of whom are currently paying a lot of attention to the Vietnamese market, although they lack information.

According to the Japanese executive, international M&A financiers have not changed their tastes too much since the outbreak of the COVID-19 pandemic, with their investments typically being injected into potential fields such as fast-moving consumer goods, retails, food production and processing, logistics, and financial services.

However, the pandemic has turned logistics services, including the cold storage supply chain, into a major concern for investors.

M&A business executives from 50 countries from Europe, the Americas, and the Asia-Pacific region attended the GMAP conference in Ho Chi Minh City to examine M&A investment trends around the world and Vietnam in particular in 2024.

Discussions also focused on helping investors to gain more understanding of the Vietnamese investment landscape, legal framework, and emerging fields.

The fields that tend to attract the attention of investors looking for M&A opportunities at the GMAP conference this time include manufacturing, retail, semiconductor chips, food, warehouse production, and fintech.

FinGroup reported that the M&A market in Vietnam was valued at nearly US$2.7 billion in the first half of the year, down 54% over the same period from last year. The number of successful transactions also decreased by nearly half in the same period.